Starting with your 2018 tax year, the laws have changed substantially. Tax accountant Vinay Navani offers ideas you can share with your tax professional to potentially reduce your tax liability.1

It’s smart to look at ways you might minimize your tax liability. That’s especially true for 2018, the first year the sweeping new tax legislation (commonly known as the Tax Cuts and Jobs Act) generally applies. In light of the new income tax rates and significant changes to traditional deductions, it’s particularly important to speak with your tax advisor, says accountant Vinay Navani, of Wilkin & Guttenplan P.C. Speak with them about some or all of the following ideas.

As a CPA and shareholder at Wilkin & Guttenplan P.C., Mr. Navani is not affiliated with Merrill Lynch. Opinions provided are his, do not necessarily reflect those of Merrill Lynch and may be subject to change. Neither Merrill Lynch nor any of its affiliates or financial advisors provide legal, tax or accounting advice. You should consult your legal and/or tax advisors before making any financial decisions.

1. Decide whether itemizing is still for you

The new law greatly increases the standard deduction to $24,000 for married couples filing jointly, $12,000 for single filers. It also places new limits on itemized deductions, including a $10,000 cap on property and state and local income tax deductions. Taking the standard deduction instead of itemizing may well make tax preparation simpler, Navani says. At the same time, work closely with your tax specialist to make sure it’s the right choice, which will depend on factors ranging from your health expenses to charitable giving (see Tips 4 and 8).

2. Max out on your retirement plan

The new laws don’t change this advice: Think about increasing your contributions to your 401(k), IRA, or other retirement plan through the end of the year to reach the maximum contribution amount. Not only does this offer the possibility of increasing your retirement savings, but it will also potentially lower your taxable income. If you’ll be age 50 or older at any time during the calendar year, take advantage of “catch-up” contributions (an extra $6,000 for a 401(k) plan and an added $1,000 for an IRA2), Navani suggests. You generally have until December 31, 2018 to contribute to a 401(k) plan and until April 15, 2019 to contribute to an IRA for the 2018 tax year.

401(k) 2018 contribution limits

* Applies to individuals who turn 50 or over at any time during the tax year.

3. Consider converting your Traditional IRA to a Roth IRA

Although there are income limits for contributing to a Roth IRA,3 anyone can convert all or a portion of their assets in a Traditional IRA (or other eligible retirement plan) to a Roth IRA. Why might doing so make sense? Unlike with a Traditional IRA, qualified distributions from a Roth IRA aren’t generally subject to federal taxes, as long as the Roth IRA has been open at least five years and you have reached at least age 59½. However, you’ll be required to pay income taxes on the amount of your deductible contributions, as well as any associated earnings, when you convert from your Traditional IRA to a Roth IRA—or, if you don’t convert, when you retire and take withdrawals from your Traditional IRA.

Depending upon your particular situation, it could be beneficial to convert from a Traditional IRA to a Roth IRA and pay taxes now, rather than holding the funds in the Traditional IRA and paying taxes upon distribution at a later date. Consult with your tax advisor to see which might suit your circumstances better.

4. Cover health care costs efficiently

Both Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) could allow you to sock away pretax contributions for qualified medical expenses your insurance doesn’t cover. But there are key differences to these accounts. Most notably, you must purchase a high deductible health insurance plan in order to take advantage of an HSA.

One important benefit of HSAs is you don’t have to spend all the money in your account each year. Though some employers allow you to roll over as much as $500 in FSA funds from year to year, generally, the funds you contribute to an FSA must be spent during the same calendar year.

Also, while you can deposit funds into an HSA up to tax day of the following year to the maximum limit and still receive a tax benefit for the current tax year, FSA contributions are generally only allowed during Open Enrollment or when you become an employee of a company.

Be sure to check your employer’s rules for FSA accounts. If you have a balance, now may be a good time to estimate and plan your health care spending for the remainder of this year. In addition, see if the account balance can be used to reimburse you for qualified medical costs you paid out-of-pocket earlier in the year.4

And, beyond HSAs and FSAs, note this important medical-expense related tax law change: If you anticipate a large, unreimbursed medical expense and can control the timing, think about incurring the cost before the end of the year so you can itemize it as a deduction. Under the new tax law, in 2018 you can deduct certain health-related expenses exceeding 7.5% of your adjusted gross income. For 2019, the deduction reverts to the previous limit of 10%.

How do health accounts compare?

Maximum annual contribution limits for 2018 |

Under Age 55 |

Age 55 and over |

Health Savings Account (HSA) Individual |

$3,450 |

$4,450 |

Health Savings Account (HSA) Family |

$6,900 |

$7,900 |

Health Flexible Spending Account (FSA) Individual |

$2,650 |

$2,650 |

Generally, HSA contributions for 2018 can be made through April 15, 2019. Be sure to check in with your employer for any applicable rules.

5. Use stock losses to offset capital gains

Now may be a good time to consider selling certain underperforming investments in order to generate a capital loss before the end of the year—which could help offset the capital gains you realize when selling stocks that are performing well. In addition, you may generally deduct up to $3,000 ($1,500 if married and filing separately) of capital losses in excess of capital gains per year from your ordinary income. If your net capital losses exceed the yearly limit of $3,000 ($1,500 if married and filing a separate return), you can carry over the unused losses to the following year. Note that under the new law, investors will continue to pay long-term capital gains taxes at a rate of 0%, 15% or 20% (depending on their overall income), but with adjusted cutoffs. Married couples filing jointly and earning less than $77,200 ($38,600 for singles) will pay 0%. Married couples filing jointly earning between that and $479,000 (or $425,800 for singles) will pay 15%, while married couples filing jointly and earning $479,000 or more ($425,800 for singles) will pay 20%.5

6. Fund a 529 education savings plan

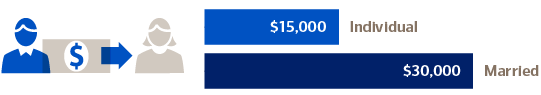

By putting money into a 529 education savings plan account, you can give a tax-free gift to a beneficiary of any age. Generally, you can make a gift of up to $15,000 per beneficiary annually ($30,000 from a married couple electing to split gifts) without having to fill out the federal gift tax form. You may also be able to contribute up to five years’ worth of gifts ($150,000 from a married couple electing to split gifts) per beneficiary in one year, as long as no other gifts are made over that period.6

Under the new tax laws, 529s may also be used to pay up to $10,000 of tuition annually for the beneficiary’s enrollment or attendance at a public, private or religious elementary or secondary school, free from federal income taxes.7 But because 529s are most effective when your investment has years to grow, they may be less beneficial for paying elementary or secondary school tuition than for college expenses, Navani notes.

7. Make tax-free gifts

You can give as many family members as you like up to $15,000 per year ($30,000 from a married couple electing to split gifts) each without reporting it to the IRS. Generally, once the gift is made, your estate will not pay estate taxes on it and it will not be considered taxable income for the recipient. Also, the lifetime federal gift and estate tax exemption has more than doubled, to $11.18 million for individuals ($22.36 million for married couples), meaning far fewer estates will owe estate tax.

Yearly gift limits per beneficiary per year

8. Donate to your favorite charity

Charitable gifts such as cash or appreciated stock are still tax-deductible if you itemize, but not if you take the standard deduction. If you give regularly to charities, consider putting several years’ worth of gifts into a donor-advised fund (DAF) for a single year—that step may make it worth your while to itemize, Navani suggests. “Then, you can spread out the giving from the DAF over the next several years, based on your charitable intent.” Another change: Taxpayers who itemize can now deduct charitable contributions of as much as 60% of their adjusted gross income, up from 50%. That could work to the benefit of, say, a retired person with significant assets and modest living expenses.

Act now: To take advantage of tax benefits, you need to make most financial moves by December 31. Consult your tax advisor for more details.

Learn more and take action