En español | When was the last time you thought about retirement? Not retirement in general, but YOUR retirement—what you’ll do, how long it might last, and when it might begin? Here’s the big question … will you be financially ready?

Consider this: Every day, roughly 10,000 people celebrate their 65th birthday1—the milestone long considered to mark the beginning of retirement. But with lifespans increasing with every decade, retirements are being redefined. No longer viewed as a time to simply “stop working,” retirement can be filled with new careers, new adventures, and new hobbies.

From hobbies to travel plans to “bucket lists,” you’ve probably considered what you’ll do in retirement. But knowing what you want to do won’t really matter if you haven’t saved enough to do it. And even if your nest egg seems sufficient now, ensuring that it lasts throughout retirement requires prioritization, and planning.

PRIORITIZE

“It will be helpful to think about your priorities and where you will need to spend, so you can get a pulse on what your income needs are in retirement. You’ll want to revisit it from time to time. Life events such as leaving the workforce, a health issue, or the need to support family members can impact your income needs.”

– Debra Greenberg, director, IRA Product, Merrill Lynch

Start by considering your financial priorities. As you inch closer to retirement, your priorities are likely to shift, but most pre-retirees share a common goal: to achieve peace of mind. In fact, a 2013 Merrill Lynch study2 found that 88% of retirees or near-retirees selected peace of mind as their number one goal. But what does that mean? After all, “peace of mind” means different things to different people. This study showed that peace of mind is more likely attained by those who can effectively juggle seven common financial priorities: finances, family, health, work, home, leisure, and giving.

As you consider how you’ll pay for retirement,

ask yourself:

- Do I want to “age in place” by staying in my current home, or will I downsize?

- What will my leisure calendar look like? Full of high-end cruises or backyard barbecues?

- Do I want to continue working in retirement, either on a full-or part-time basis?

- Will I continue to provide financial support to family members?

- How much do I plan to give to organizations or causes important to me?

- How much should I set aside for healthcare expenses?

- What does my retirement income plan look like?

PLAN

Having answers to these questions will help you determine how much you may need for retirement. Remember: Just like your working paycheck, your income in retirement must cover predictable daily expenses, unexpected expenses, and discretionary expenses. While some expenses may go down in retirement—for instance, your mortgage or commuting expenses—you can expect others to rise. And, while some expenses can be controlled, others, such as medical emergencies, cannot.

One of the biggest expenses you can anticipate in retirement? Health care costs. In fact, a 65-year-old with Medicare may pay more than $5,000 a year in out-of-pocket health care costs.3

Will you have enough money to cover all of your priorities in retirement? How do you plan to replace your working paycheck after you’ve retired? Your retirement income will likely come from several sources including retirement plan assets, investment income, earned income, pensions, and Social Security.

If after taking stock of your income, you find that you’re falling a little short, you can make a few smart moves now that can increase your chances of having more later:

1) Invest for growth – While you may be tempted to shy away from stocks to reduce risk, the growth that stocks may provide is important. Consider maintaining a mix of stocks, bonds, mutual funds and other assets that fits your risk tolerance and investment time horizon.

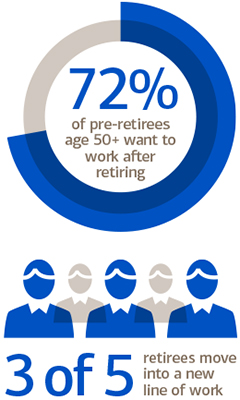

Source: 2014 Merrill Lynch/Age Wave Study

"Work in Retirement: Myths and Motivations"

2) Max your retirement accounts – Whenever possible, increase your retirement contributions up to the maximum allowed in your 401(k), IRAs, and other retirement plans. Plus, if you're age 50 or older, you can put away even more by making catch-up contributions. The IRS catch-up limits for 2015 are:

- $24,000 for 401(k) plans

- $6,500 for IRAs

3) Downsize your debt – Think about accelerating your mortgage payments so that the loan will be paid off before you retire. Also, try to pay down any credit card debt, especially if it’s on a high-interest card.

4) Consider your timeline – By deciding to work longer, you’ll have more time to invest in your 401(k) or IRA. Plus, you’ll give your assets more time to potentially grow. If you postpone taking Social Security benefits, your monthly check will increase. In fact, if you wait until age 70, you’ll receive 76% more each month.4

5) Think about your locale – Are you living in an expensive area with high property taxes? If so, downsizing your home or moving to a less expensive area can free up some income.

Thinking about your financial priorities well in advance of retirement will help make the transition that much easier. After all, you’ve spent your career planning for retirement. You want to make sure you’re well prepared to make it your best chapter yet.

Learn more and take action

- Run your numbers! Visit our online retirement planning calculator to evaluate your progress towards your goal.

- Meet with a financial professional to periodically evaluate your retirement income plan.

If your company's 401(k) plan is with Merrill Lynch, visit Benefits OnLine to:

- Increase your contribution rate, or take advantage of catch-up contributions if you are age 50 or older, at 401(k) > Current Elections > Contribution Rates > Change Contribution Rate.

- Check out Advice Access if your plan offers it. Based on input provided by you and your employer, Advice Access will tell you how much income you may need in retirement, and recommend an investment strategy to help keep you on track.